TAKE STOCK OF YOUR CURRENT FINANCIAL SITUATION

Discovering yourself Financially

The prospects of high returns and daily stock quotes can be overstimulating at times , and for many this can be confusing. Many have come to believe that investing is difficult because of the copious amounts of websites and information available. Some common myths are that investing is just the same as gambling away your hard earned(saved) cash in a poker game on casino night.

This is contrasted by the patience and intelligence actually needed to build and accumulate wealth using a logical and rational investing philosophy and helpful advice from professional wealth planners.

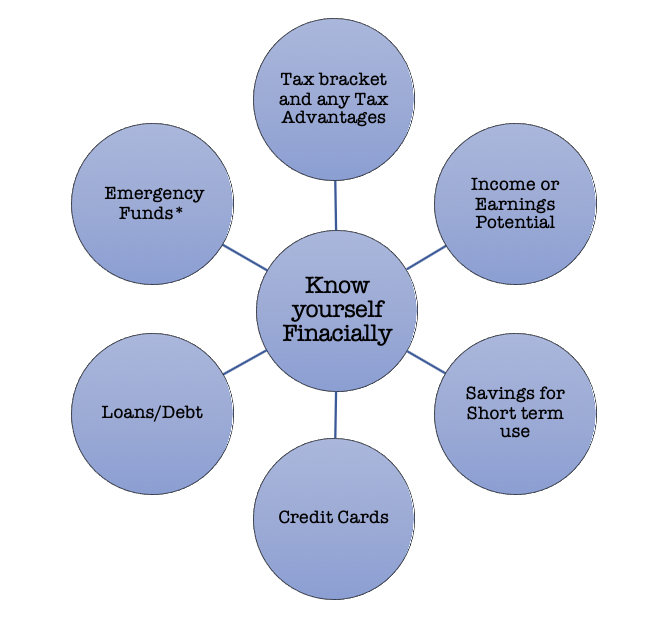

The potential for gain is there, there is no doubt about that, but the key component needed is understanding yourself and what you want to achieve from the market.

“James”

Let’s take a hypothetical example of a young professional who has recently graduated from university or is currently in university. To actually test this theory the graduation date of this individual ,let us call him James, will be December 31, 1960.

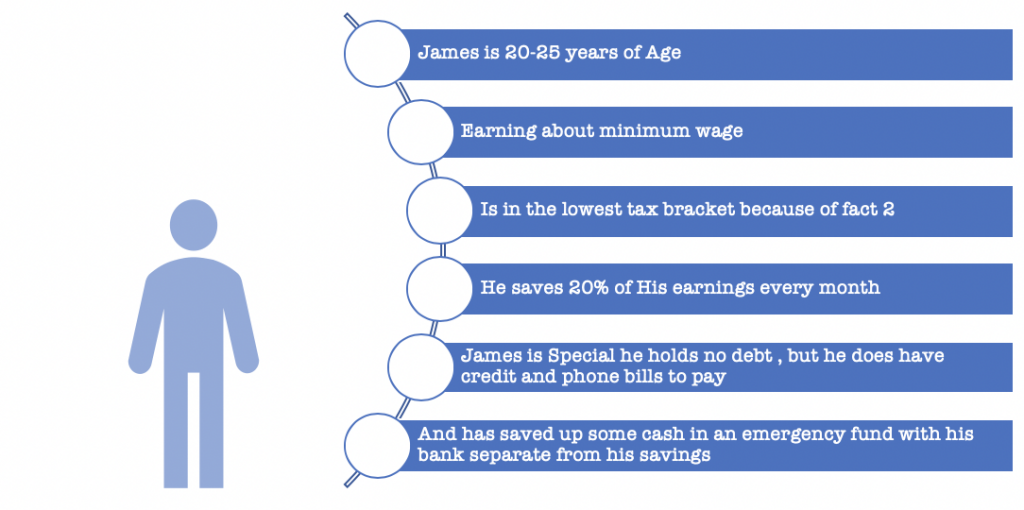

Some facts about James:

James has managed to save up $100 dollars at the end of the Year(1960) and has asked for some help from his financial planner on what to do with his savings. James is a young professional so is fully aware that if he keeps his money in the bank or under a mattress at home inflation will eat at his wealth slowly at 2% per year on average. His Financial Planner suggests after considering James’ risk and return characteristics that putting away the money for the long haul and allowing a diverse cross section portfolio of companies to put that $100 to work is best for him.

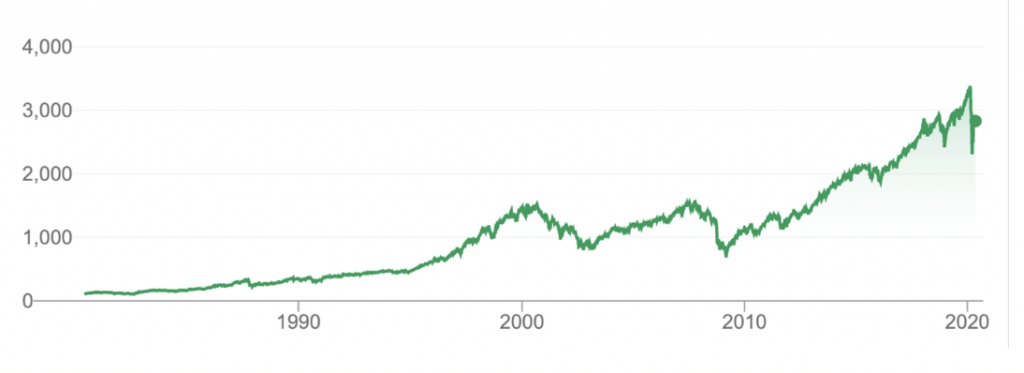

James puts his money in a safe S&P 500 index mutual fund. An index mutual fund is designed to follow certain rules so that the fund can track a specified basket of underlying investments. For James his index funds rule is to track the S&P 500 which is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States(500 companies that seems well diversified). James also believes he will find employment soon in a stable job and does not need that money for a long period of time, say he only needs his money after 60 years .

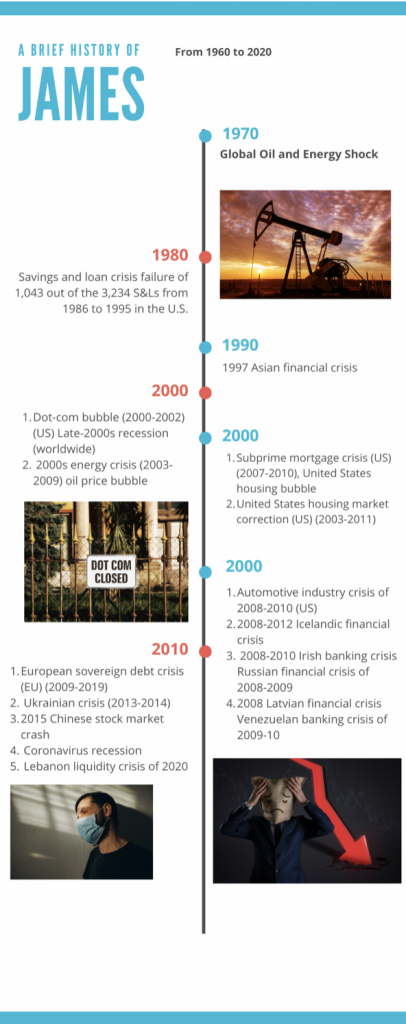

Now that it is 2020 you might be wondering how his portfolio has done since the 1960s. Before we get to the performance of the portfolio let us take a look at some of the key events that happened during James’s life over this period.

It seems from the above that James and his Financial Planner picked the worst 6-decade time period to invest that $100.

With that factored in how was the performance of his portfolio? Surprisingly after all those social and economic trials and tribulations he did well.

From 16 May 1980 till 13 May 2020 the total return from his portfolio was an annual compounded return of 5.6%. James only started in 1980 because he took some time to pay off his credit card and restructure his goals accordingly. At this rate of return, this means that James’ initial $100 in 1980 grow for 60 years until it was a total of $1525. Even with all the economic and social uncertainty that both James and his Planner could not have planned for they did one very important thing correctly and that is they took the time to understand what his financial position was, and what his financial goals were.

This hypothetical case is very simplified, and many assumptions have been either (1) used or (2) made up, but the key lesson is that one should not think of getting invested using forecasts or tips from a neighbour but take stock of their own situation and factor in their :

Key Take always

Establish a Personal Balance Sheet.

- Make sure you have an Emergency Fund

- List your Assets in order of liquidity.

- List your liabilities

- Calculate Your net-worth

- Analyze your personal Balance Sheet

Establish a Personal Income Account.

- Talley your incomes and wages/salaries

- Find out a proxy of your expenditures

- Create a budget or cash flow for yourself(Inflows – Outflows)

Establish your financial goals and time horizon

- Set Goals

- Seek for Help from a Professional Accountant or Financial Planner

LEGAL DISCALIMAR : The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice . I am not an attorney , accountant or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary , nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our particular information. The Company expressly recommends that you seek advice from a professional.