What are the Common Approaches to Investing?

Investment Vs Speculation

Before we even start discussing the types of investing it is important to notice how common it is today to cover gambling and investing under one shared blanket. When many are asked to define investing the most common response is putting money away today to earn more tomorrow. Although this is partially correct it does not help us with the gambling and investing fallacy.

To try improving upon this definition would be a difficult endeavor even for those who are professional investors, as the lines between the two have blurred with time.

But this does not mean a general definition cannot be constructed that helps the reader distinguish between gambling and investing.

We use the process of elimination to distinguish between investing and speculation, if the approach does not meet the high standards, we are about to set out then this operation outside this purview and will be gambling.

If we are to look at the common response of the definition of investing, we notice two key characteristics, namely:

- Safety of your money today to get back approximately what you put in later in the future

- You only forgo consumption today, if you are sure your “investments” will bring you a return that does not leave you worse off tomorrow.

From this we can pose a general definition of investing as “a process where an individual/individuals conduct(s) due diligence with their asset or investment options, to protect their principal investment and achieve an adequate return. Any operations not meeting this standard will be defined as Gambling.“

Now the piece de resistance , we put two individuals to the test to see what approach they are using.

Amaya & James

After a few weeks of analyzing Nile.com, his Financial Planner sends James an email and informs him that Nile.com is both operationally and finically sound and fits his investment criterion.

Performance

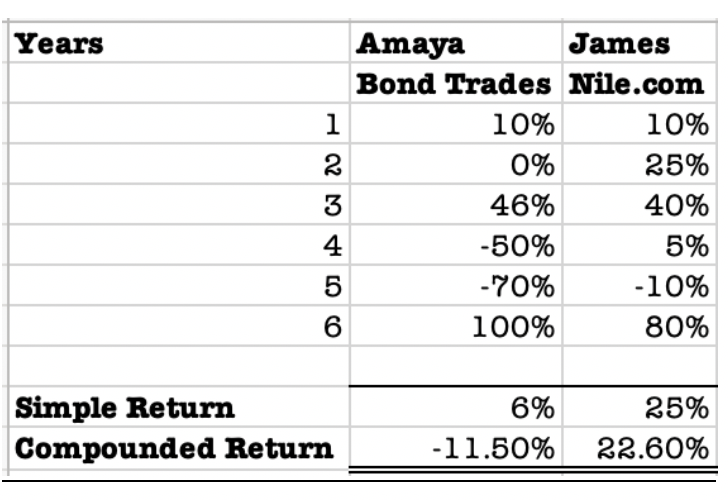

Amaya and James(with his Financial Planner) both put 100 dollars into their respective systems and allow their strategies to put the money to work over a 6-year period.

Amaya was right! Her models were able to always beat James every time the market was up at the end of the year. For example, in year 3 and 6 , but she experienced some heavy downturns in years 4 & 5 just as she predicted .

But what actually happened to the $100 invested in both systems? Amaya had a negative return of 11.5% over the 6-year period and James had a positive return of 22.6% meaning the money invested was now about $50 and $340 respectively.

Both systems worked as planned but which one meets our standards of investment? We leave this question here for the reader to interpret and come to their own conclusions using the definition above.

Types of investment

Once the reader feels comfortable with their understanding of Investing vs Gambling, we can now focus more on the styles of investing. There are mainly two styles that can be broken down further into many different subsets. These are ;

- Active

- Passive

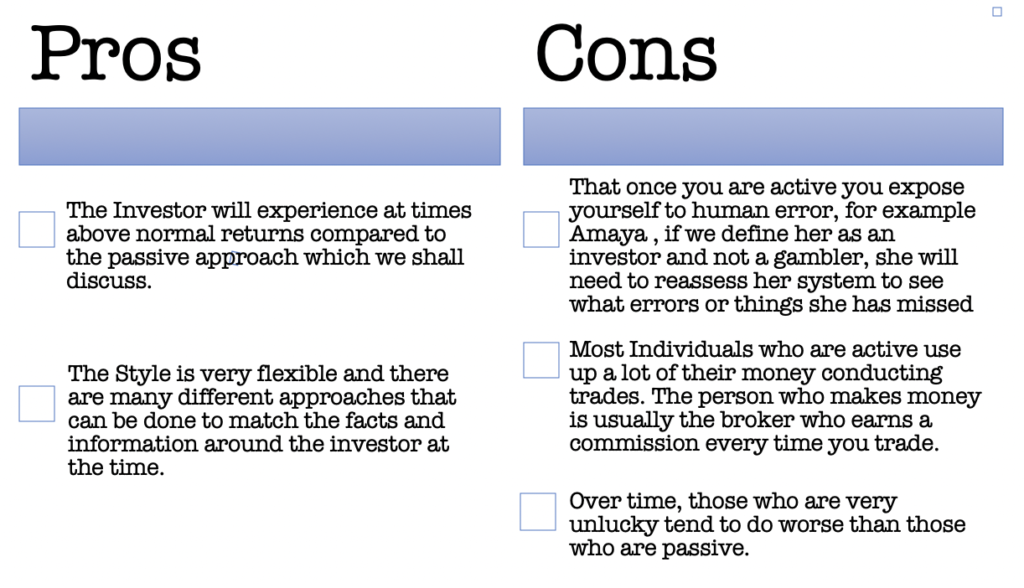

Active Investing

Active-Investors can plan long term or over the intermediate-term, but in any case, they want to be invested in assets that show high growth prospects and follow certain market trends and the business cycle etc. These individuals are more active for example both Amaya and James “could” be defined as intermediate active investors. They actively seek out assets that have three characteristics

- Great Growth potential, these are investments that have above-average performance and are expected to grow exponentially.

- Price Appreciation, most active investors are interested in an increase in the prices of the asset they own and not on the income it provides.

- Creativity and Innovation, they are looking for creative destruction, those assets and companies that are ground-breaking.

Active investing has lost its shine during last few years despite the market prosperity. Even though they have been very popular in the past, professional money managers and algorithmic trading have not been able to beat passive investing.

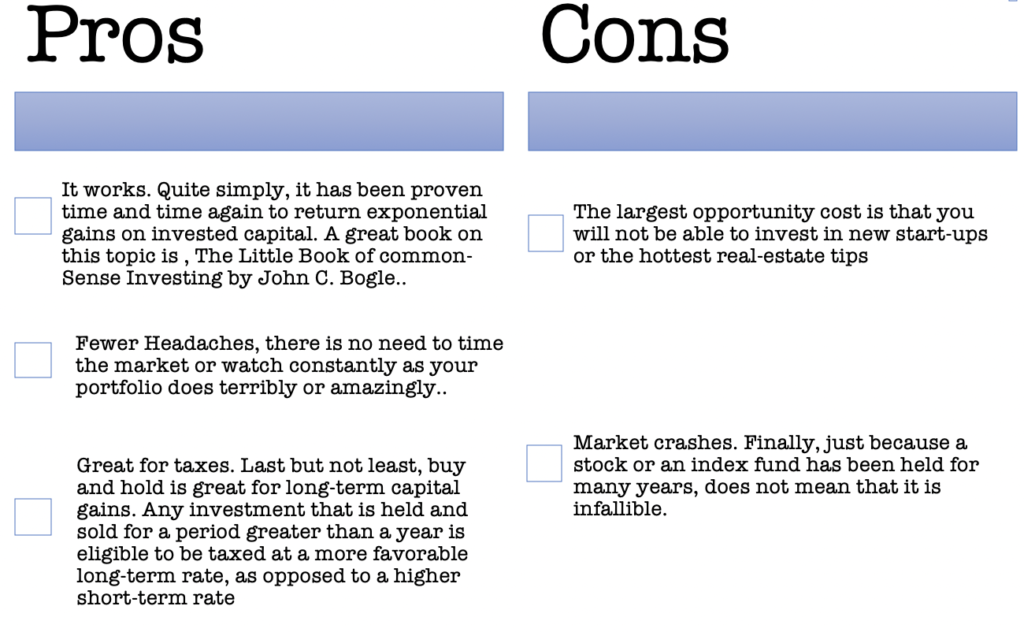

Passive Investing

Simply put passive investments is putting your hard-earned money in something proven, tried, and true and doing the hardest thing in investing, NOTHING! You invest your money in a well-diversified cross section of asset classes.

They look for assets that show Proven performance, these are assets that simply have shown over time that they are able to return adequate returns and are stable, Think Government of Canada Savings Bonds or the S&P 500 Vanguard Index.

Key Takeaways

- Know Yourself

- Seek for Help from Your Financial Advisors, Accountants and Other Professionals

- Show an ability to distinguish between investing and Gambling

- Understand What approach works for you because you Know Yourself and Apply that system consistently and change not according to trends but facts

LEGAL DISCALIMAR : The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice . I am not an attorney , accountant or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our particular information. The Company expressly recommends that you seek advice from a professional.